Introduction

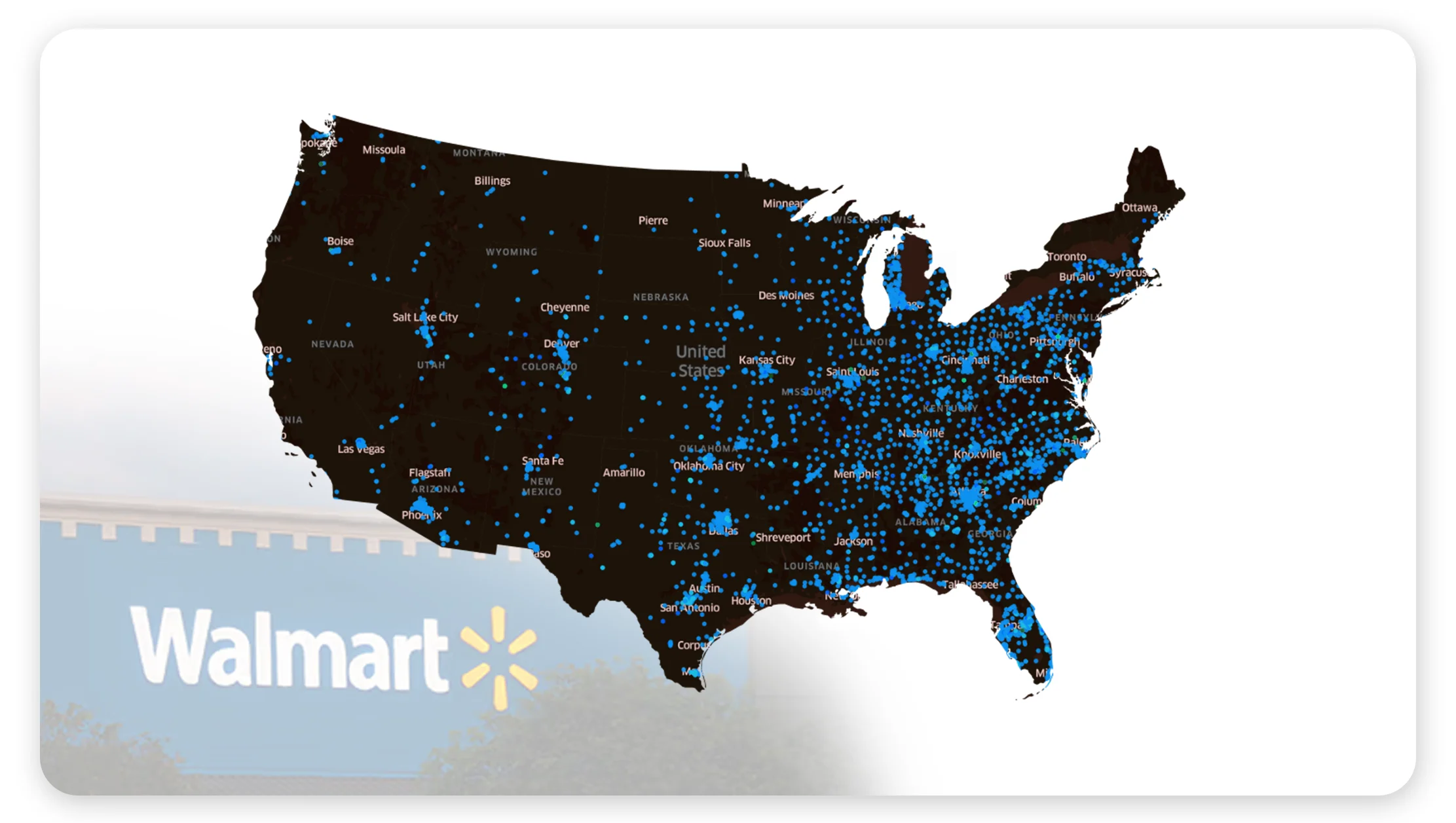

Walmart is one of the largest retail chains in the world, with thousands of stores across the United States. Extracting store location data provides valuable insights into Walmart’s market reach, expansion trends, and geographical distribution. By leveraging web scraping techniques, businesses and researchers can track Walmart’s footprint, analyze retail expansion, and identify emerging market trends. This report delves into the insights gained when scraping Walmart stores in America.

Methodology

To analyze Walmart's presence in the USA, we extract USA Walmart stores data through automated web scraping techniques. This process involves gathering store addresses, geographical coordinates, city-wise distribution, store formats, and opening/closing trends. The extracted data is then structured and visualized to uncover key insights into Walmart’s retail strategy and market influence.

Insights Gained

1. Total Number of Walmart Stores in 2025

The latest data extraction reveals that Walmart operates approximately 4,700 stores across the United States. This number includes Supercenters, Neighborhood Markets, and traditional Discount Stores.

2. Geographical Distribution

The Scrape Walmart Product Prices and Details method provides businesses with up-to-date pricing information. By tracking price fluctuations, businesses can:

The highest concentrations of Walmart stores are found in Texas, California, and Florida, making these states key retail strongholds for the company.

Rural areas tend to have a higher density of Walmart Supercenters due to the need for large-format stores that provide one-stop shopping.

Urban locations, on the other hand, feature a growing number of Neighborhood Markets and smaller-format stores to cater to city dwellers.

3. Store Type Analysis

Supercenters: Comprising the majority of Walmart’s store network, Supercenters provide a vast selection of groceries, clothing, electronics, and home essentials under one roof.

Neighborhood Markets: These are compact stores focused primarily on groceries and everyday essentials, catering to high-density urban populations.

Discount Stores: Traditional Walmart stores that specialize in general merchandise at competitive prices, though their numbers have been declining in favor of Supercenters.

4. Growth Trends

A multi-year analysis of web scraping Walmart stores data shows a clear trend of expansion in suburban and rural markets, with new Supercenters being established in growing residential areas.

The data also suggests a decline in older discount store formats, as Walmart shifts its focus toward modern retail solutions such as e-commerce integration and fulfillment centers.

Walmart’s strategic real estate investments emphasize locations near major transportation hubs, allowing for efficient supply chain logistics.

5. Market Penetration by State

A detailed examination of store location data highlights states with the highest number of Walmart stores, including Texas, Florida, and Georgia.

States with stringent zoning laws and commercial real estate restrictions, such as parts of the Northeast, have fewer Walmart locations.

Emerging trends indicate Walmart’s increasing presence in states with growing populations and economic development, leading to new store openings in suburban and exurban regions.

Visualization

The chart below represents the distribution of Walmart stores across the top 10 states in 2025, showcasing their market penetration and density.

Conclusion

Extracting Walmart store location data in 2025 reveals crucial insights into the company’s retail footprint, expansion strategy, and evolving business operations. Businesses, investors, and market analysts can utilize this data to assess Walmart’s dominance in specific regions, track emerging retail trends, and optimize logistics and supply chain strategies. Web scraping Walmart stores data provides a powerful tool for understanding market dynamics and making data-driven business decisions.